The Middle East and Africa (MEA), the fifth-largest regional pharma market in the world, is rapidly becoming a pharmaceutical powerhouse with both global and local firms taking advantage of the region’s population and life expectancy growth as well as greater government funding for healthcare and the progress of universal healthcare programs. Key trends to watch in the region include positive investment prospects in Saudi Arabia, expedited approvals in Egypt and the spread of public-private partnerships in the UAE.

1. Saudi Arabia: Positive Outlook for Investment

Saudi Arabia, with USD 8.5 billion in value, remains the largest pharma market in the region. The country’s Vision 2030, first unveiled in 2016, constitutes an ambitious strategic framework aiming to scale back Saudi Arabia’s dependence on oil revenues, diversify the national economy, and re-energize public services. The Vision’s impact on healthcare and life sciences is far-reaching and stands to encourage international investment.

Made with Visme Infographic Maker

Vision 2030 confirms the country’s commitment to universal healthcare coverage and explicitly identifies life sciences as a sector of strategic national importance. “What’s especially good to see coming out of this new agenda is that the Saudi authorities appreciate the contribution of our industry to building an advanced and diversified innovation-driven, knowledge economy and that they are fully cognizant of the economic implications of investing in healthcare,” states Jamie Phares, managing director for the GCC at Janssen.

This recognition has built confidence among international investors. “Since the Vision is endorsed by strong and resolute leadership, we see an alignment across the country – including across the various ministries, institutions, and healthcare authorities – around a common set of KPIs. This should, in turn, hand MNCs the confidence to invest because it limits their risk and allows them to make a fair assessment of the predictability of returns,” states Sameh ElFangary, country president for the GCC and Pakistan at AstraZeneca.

Find out more in the 2022 Healthcare & Life Sciences Review, Saudi Arabia.

2. Egypt: Faster Approvals

Egypt’s pharma market, estimated to be worth around USD 6.3 billion in 2021, now ranks second only to Saudi Arabia within MEA in terms of value. As the country undergoes healthcare and life sciences reforms and launches an ambitious universal health insurance system, it is also restructuring its government agencies and streamlining processes to speed up drug registrations.

The application of the new health insurance system has translated into the creation of three new government agencies: “namely the inauguration of the UHIA as purchaser, the establishment of the Healthcare Organization (HCO) as provider, and the opening of a General Authority for Healthcare Accreditation and Regulation (GAHAR) dedicated to quality assurance and accreditation,” Novartis’ country president Sherif Amin explains.

Industry stakeholders applaud the transparency this new distribution of responsibilities provides, as opposed to a single entity handling multiple functions: “We now have a much more transparent separation of duties, missions and specializations. This is most welcome because it provides considerably better clarity for all stakeholders including industry,” says Samy Khalil, country lead at Takeda. Moreover, the beefed-up and freshly empowered Egyptian Drug Authority began operating as an independent regulatory body in 2020. Not only has this served to consolidate drug registration procedures, it has resulted in significantly faster registration timeframes. “Clearly a lot of work has gone into ironing out the bottlenecks because what used to take three years has, in certain instances, now been brought down to about six months,” confides Sanofi’s country manager Ahmed Raouf.

Find out more in the 2022 Healthcare & Life Sciences Review, Egypt.

3. Infrastructure Boom and Centres of Excellence in GCC

In recent years, the Gulf Cooperation Council (GCC) countries Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE) have seen significant spending on healthcare infrastructure with the number of hospitals almost doubling between 2010 and 2020. At least 80 percent of these hospitals and primary care clinics were driven by government initiatives and expansion plans, according to Trade Arabia.

Healthcare spending in the UAE is set to reach up to USD 26 billion by 2028 with 700 healthcare projects under development making up a total investment of USD 60.9 billion, according to the UAE Ministry of Economy and UAE International Investors’ Council. In Saudi Arabia, under the Vision 2030 transformation plan, the Saudi government plans to invest over USD 65 billion to develop the country’s healthcare infrastructure. In addition, it aims to increase private sector contribution from 40 percent to 65 percent by 2030, targeting the privatization of 290 hospitals and 2,300 primary health centres.

The question for the region’s governments now is in which specific areas to direct investment. “What is happening now in terms of hospital infrastructure is a move to specialization and centres of excellence such as cancer, ophthalmology, or children’s hospitals,” states Marwan Abdulaziz Janahi, managing director of Dubai Science Park (DSP), which last year hosted the opening of a USD 190 million Neuro Spinal Hospital offering technological solutions and treatments that were previously unavailable in the region.

Find out more in the 2022 In Focus: The Future of Healthcare in the GCC.

4. Public-Private Partnerships in UAE and Saudi Arabia

The rise of private sector providers over the last decade marks a significant trend in GCC healthcare and one that looks set to evolve further. “With population growth and the rise in non-communicable and lifestyle diseases coupled with a growing ageing population; the demand for quality healthcare surged, hence the need for a private sector to take on part of the demand. In the past ten years, we’ve seen a vibrant private sector gaining momentum and an increase in investment in tertiary and specialized centres,” says managing director of the MedServe Medical Investment consultancy, Maher Abouzeid.

Countries in the region are looking at healthcare system models, with a hybrid public-private model presenting clear advantages. “We are seeing a hybrid healthcare model emerging with cooperation between the public and private sector. The public sector will become the regulator and outsource care delivery to private players delivering efficient premium and sustainable care enabled by technology and digitalisation,” Abouzeid continues.

The UAE and Saudi Arabia are two of the nations spearheading the region’s public-private partnership (PPP) trend. With respect to the UAE, Dr Younis Kazim, CEO of Dubai Healthcare Corporation, which was established in 2018 to manage and operate all government health care facilities in Dubai, claims that Dubai has instituted a roadmap for PPP in new hospital projects. “We are talking to a number of investors in the healthcare sector where the demand is growing, especially in rehabilitation clinics, mental healthcare facilities and dialysis centres,” he confirms. “We have a number of PPP models through which investors can develop healthcare facilities – be it a hospital, clinic or other health-related facilities.”

In Saudi Arabia, PPPs have had a similarly positive impact. In the view of Tarek El Rahbani, Sr. Managing Director, Growth Emerging Markets-South (Middle East & Africa) at Boston Scientific: “As part of the country’s healthcare transformation we continue to see a growing need for more centres, especially in remote areas, which the government is now trying to meet through PPPs. In the past, the government oversaw the building, operation, and maintenance of hospitals, but they have now realised that the private sector has an important role to play, providing upfront investment and delivering healthcare in return. The private sector is often more efficient and effective; that is how the country was able to deliver better services for the same or even less cost.”

Find out more in the 2022 In Focus: The Future of Healthcare in the GCC.

5. Looking Towards Exports in Turkey

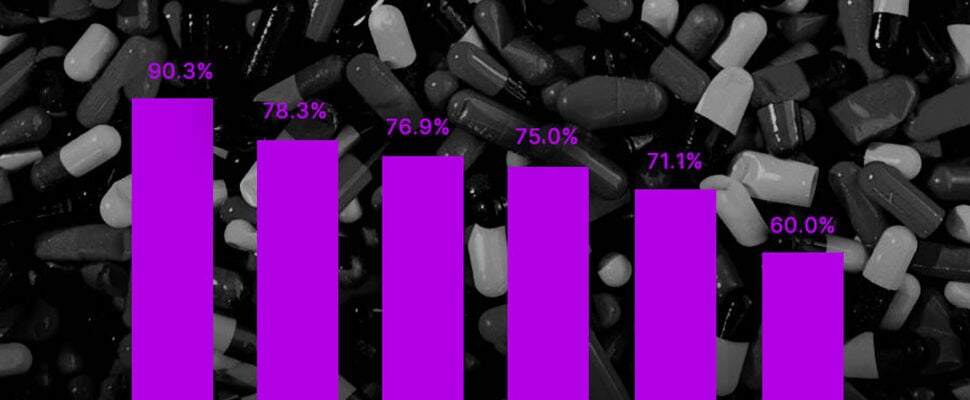

A key trend in the Turkish life sciences sector is the increasing tendency for local pharma and medtech firms to look overseas. This is reflected in the trajectory of the country’s trade statistics, which have more than doubled over the past decade with a 60 percent rise registered between 2019 and 2021. In part, this tendency is testament to the maturity of the manufacturing base and the state’s efforts to encourage the practice with a view to narrowing the trade deficit in medicines, but equally it is born out of necessity as a result of the country’s longstanding currency volatility and fixed exchange rate. “The issue is that the Ministry of Health has implemented a special Euro exchange rate which is not related to the reality on the ground,” says Recordati’s İsmail Yormaz. “The domestic price pressures have been driving companies to look abroad because there’s a vast gap between the prices you can secure overseas for medicines compared the ones you obtain domestically as a result of the special exchange rate,” notes Ersin Erfa, CEO of Centurion Pharma.

Because Turkish products are substantially less expensive than European equivalents, this gives Turkish companies a competitive edge: “There’s a competitive advantage to be had since Turkish products are considered high-quality but are markedly less expensive than European products,” states Ufuk Kumrulu, the chairman of Polifarma.

Turkey’s drugmakers have not, however, shunned the domestic market. “I don’t think anyone is thinking of turning their backs on the home market where there’s still very good business to be had, but it makes sense to supplement those revenue streams by taking advantage of the new opportunities that are opening up and to de-risk dependency on a single source,” reasons Süha Taşpolatoğlu, CEO of Abdi Ibrahim, one of Turkey’s homegrown success stories.

Despite the great headway made in increasing the volume of Turkish medicine exports, almost half of originator drugs as well as vaccines, blood products, and biosimilars still need to be imported. In 2019, imported drugs may have held a market share of only 12 percent in units, but almost 50 percent in value.

Find out more in the 2021 Healthcare & Life Sciences Review, Turkey.