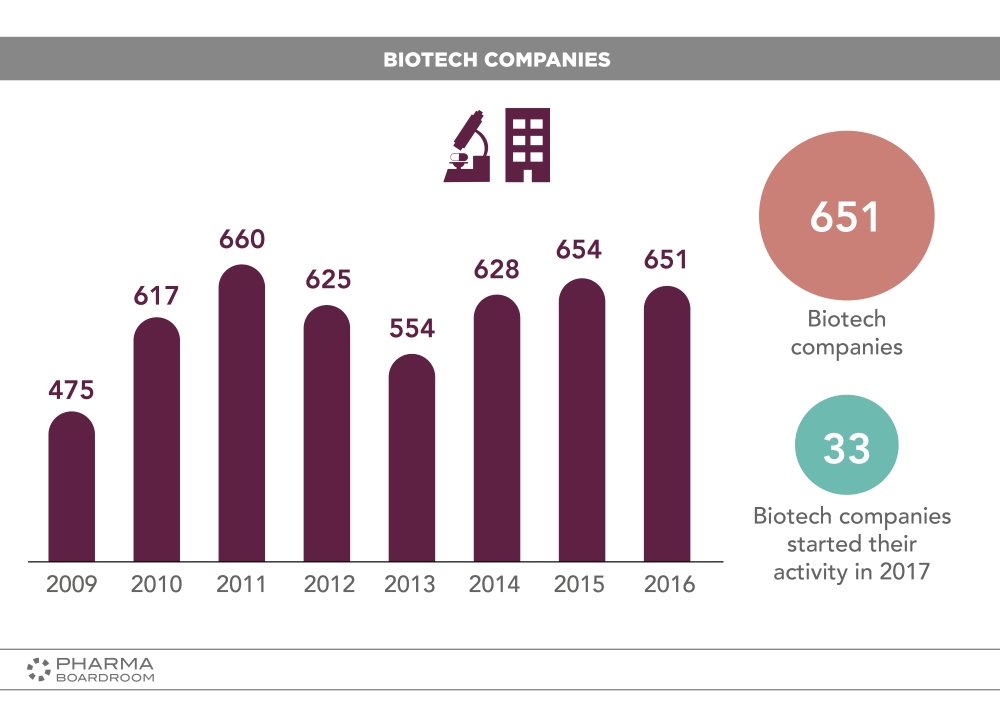

Spain’s biotech scene is on the rise. In 2016 alone, the nation had a total of 651 biotech companies, with a total of 33 commencing operations in 2017. Despite these quite modest numbers in comparison to more well-established global biotech hubs, they have been accompanied by some extremely encouraging exits.

In January this year, Qiagen acquired Stat-Dx, a Spanish diagnostic technology company, for roughly USD 200 million, while in April, Takeda continued its spending spree by acquiring Genetrix, a Madrid-based enterprise focused on molecular and cell therapy, for over USD 500 million. These recent successes build on the foundation set by the shining star of Spanish life sciences, PharmaMar, a company that many believe has the potential to discover a breakthrough treatment for small-cell lung cancer.

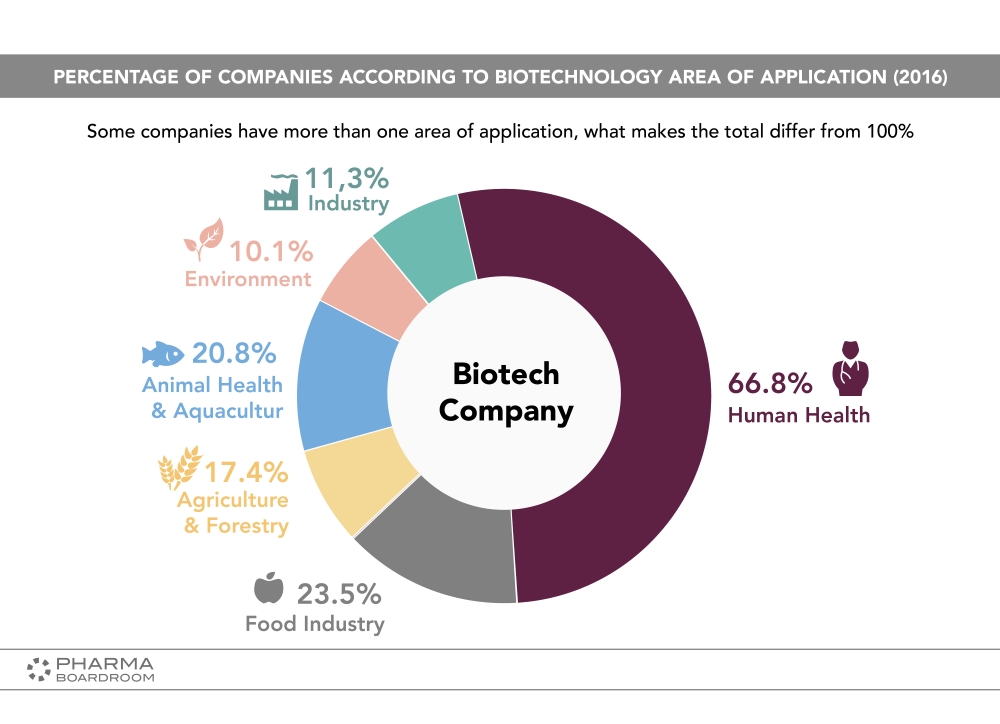

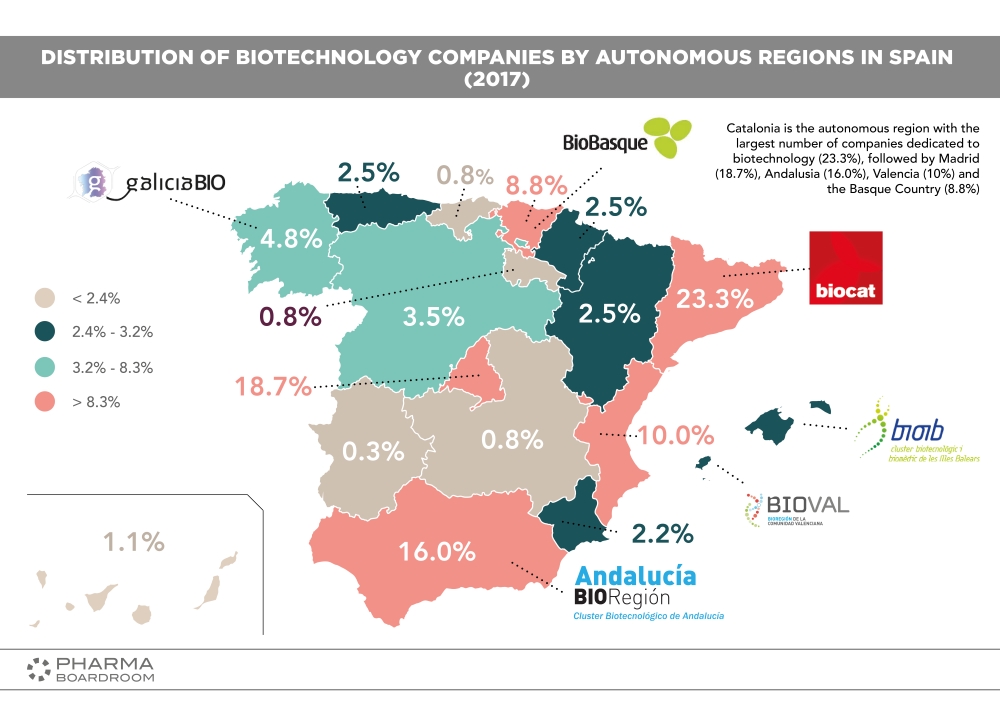

If you look at the Spanish biotech sector in 2017, according to Asebio, the Spanish biotech association, the industry was dominated by Catalonia with 23.3% of all biotech companies, followed by Madrid at 18.7%, and Andalusia with 16% of the market share. Furthermore, in 2016, 66.8% of all biotech companies had a focus on healthcare, the largest sector by a significant margin (second position was the Food Industry with 23.5%, and third, Animal Health and Aquaculture with 20.8%).

This biotech rise is being led by ASEBIO, and CEO Ion Arocena, who has seen the improvement over the long term. As he puts it “The Spanish biotech industry did not become a thriving sector overnight. Ten years ago, the right policies were put in place, there was money being invested into research and that started to create the right conditions for the industry to develop”.

This biotech rise is being led by ASEBIO, and CEO Ion Arocena, who has seen the improvement over the long term. As he puts it “The Spanish biotech industry did not become a thriving sector overnight. Ten years ago, the right policies were put in place, there was money being invested into research and that started to create the right conditions for the industry to develop”.

As aforementioned, Catalonia is the leading player in the market, and this is not lost on Jordi Naval, CEO of Biocat, the Catalan Biotech Cluster. He notes that “today, more than 60 percent of all the healthcare and biotech innovation of Spain is happening in Catalonia, and Barcelona is where international investors are really coming to look for breakthrough innovations with a global reach”. What gets Naval even more excited is the fact “the level of investment over the last few years has increased substantially. We have reached the level of around EUR 130 million invested yearly into local companies having moved from EUR 50 million in 2014. Furthermore, 72 percent of all venture capital attracted by Catalan start-ups in the sector this year (specifically EUR 42.7 million of a total of EUR 60.9 million) was through rounds of funding with international participants”.

With the potential of the Spanish biotech wave, we picked at five local biotech players that are looking to breakthrough into the limelight:

Aelix Therapeutics is a Barcelona based company focused on the development of a therapeutic HIV vaccine to be used in cure or possibly eradication. The company was originally founded in 2015 as a spin-off of HIVACAT, a Catalan public-private consortium conducting cutting-edge research in this field.

Since receiving EUR 11.25 million in funding, the signs for success are promising as the company recently signed a Clinical Research Collaboration Agreement with pharmaceutical giant, Gilead Sciences, to evaluate a therapeutic vaccine and TLR7 Agonist Regimen for HIV Cure. John McHutchison, chief scientific officer at Gilead Sciences understands the potential and believes “This collaboration will bring together two promising investigational agents that are already being tested independently in early-stage trials.”

Oryzon Genomics is a promising biotechnology company with two compounds in clinical trials, Iadademstat (ORY-1001), a highly potent and selective LSD1 inhibitor that has been granted orphan-drug status by the EMA in Phase IIA in oncology, and Vafidemstat (ORY-2001), a dual LSD1/MAO-B inhibitor for the treatment of multiple sclerosis, Alzheimer’s disease and other neurodegenerative diseases, in Phase IIA. From 2014 to 2017 the company had a collaboration with Roche in oncology and received over EUR 23 million in funding.

Oryzon Genomics is a promising biotechnology company with two compounds in clinical trials, Iadademstat (ORY-1001), a highly potent and selective LSD1 inhibitor that has been granted orphan-drug status by the EMA in Phase IIA in oncology, and Vafidemstat (ORY-2001), a dual LSD1/MAO-B inhibitor for the treatment of multiple sclerosis, Alzheimer’s disease and other neurodegenerative diseases, in Phase IIA. From 2014 to 2017 the company had a collaboration with Roche in oncology and received over EUR 23 million in funding.

Sanifit was founded in 2007 and is as a spin-off from the University of the Balearic Islands, and has offices in Palma (Spain) and San Diego (USA). The main product is SNF472, an experimental drug in development for the treatment of cardiovascular diseases related to calcification in the End Stage Renal Disease (ESRD) for patients undergoing hemodialysis. In 2018 Sanifit completed a Phase II proof of concept trial in patients with calciphylaxis and now has plans to initiate a Phase III study in this orphan disease in 2018.

Sanifit was founded in 2007 and is as a spin-off from the University of the Balearic Islands, and has offices in Palma (Spain) and San Diego (USA). The main product is SNF472, an experimental drug in development for the treatment of cardiovascular diseases related to calcification in the End Stage Renal Disease (ESRD) for patients undergoing hemodialysis. In 2018 Sanifit completed a Phase II proof of concept trial in patients with calciphylaxis and now has plans to initiate a Phase III study in this orphan disease in 2018.

Minoryx Therapeutics is in the clinical stage for the development of new therapies for X-linked adrenoleukodystrophy (X-ALD) and other Orphan CNS diseases. The company’s leading program, a differentiated PPAR gamma agonist (MIN-102), is a candidate for X-linked Adrenoleukodystrophy that has successfully completed Phase I clinical trials and is now in a pivotal Phase II/III trial. The Roche-backed company has this September attracted a further investment of EUR 21 million.

Minoryx Therapeutics is in the clinical stage for the development of new therapies for X-linked adrenoleukodystrophy (X-ALD) and other Orphan CNS diseases. The company’s leading program, a differentiated PPAR gamma agonist (MIN-102), is a candidate for X-linked Adrenoleukodystrophy that has successfully completed Phase I clinical trials and is now in a pivotal Phase II/III trial. The Roche-backed company has this September attracted a further investment of EUR 21 million.

Medlumics, though not strictly a biotech, is a medical device innovator that designs and manufactures integrated photonic devices using optical coherence tomography technology (OCT): in short, a non-invasive light based diagnostic technique that provides cross sectional information about a tissue in high resolution.

Medlumics, though not strictly a biotech, is a medical device innovator that designs and manufactures integrated photonic devices using optical coherence tomography technology (OCT): in short, a non-invasive light based diagnostic technique that provides cross sectional information about a tissue in high resolution.

With Ablaview, Medlumics is designing an optical guided RF catheter for the treatment of atrial fibrillation and other arrythmias. Using their technology, they can determine catheter wall thickness and contact quality. The company is currently completing development of a clinical version of the catheter with 360 real time view of tissue through the round end catheter tip. The company raised 34.4 million EUR in Series B funding in 2017, the largest ever funding round for a Spanish medical device innovator.